The journal entries below act as a quick reference for accounting for insurance proceeds. I made another journal entry for this payoff and debited the Note payable and credited the Gainloss account.

Insurance Journal Entry For Different Types Of Insurance

365 days January 25 to March 31 65 days 300 days of insurance cover remaining.

. However as the inventory asset is a current asset it does not have a related accumulated depreciation or amortization account like the fixed asset. Note that the ending balance in the asset Prepaid Insurance. In each successive month for the next twelve months there should be a journal entry that debits the insurance expense account and credits the prepaid expenses asset account.

Founder of Accounting Basics for Students. Cash Insurance Payment - 22000. In each successive month for the next twelve months there should be a journal entry that debits the insurance expense account and credits the prepaid expenses asset account.

Claim receivable is asset so debited. Cash comes in so debited. To loss by fire ac.

The company will record the payment with a debit of 12000 to Prepaid Insurance and a credit of 12000 to Cash. Example Journal Entry for Prepaid Insurance. Insurance Journal delivers the latest business news for the Property Casualty insurance industry.

Journal Entries when Prepaid Insurance is Due. The journal entry for insurance claim received for the inventory asset is similar to that of the fixed asset as they are both need to be removed from the balance sheet once destroyed. Cash - 3000.

The insurance company pays 22000 DIRECTLY TO THE LENDER and 3000 balance is paid out of pocket. Write off the damaged inventory to the impairment of inventory account. If claim is received the journal entry is aa follows.

What will be the journal entries to record the totaled vehicle on the books. When the claim is agreed set up an accounts receivable due from the insurance company. Cash Insurance out of pocket.

When the insurance premiums are paid in advance they are referred to as prepaid. Basically the cash discount received journal entry is a credit entry because it represents a reduction in expenses. When insurance is due for each quarter ie 2000 will be subtracted from the prepaid account and is shown as an expense in the income statement for that reporting quarter.

There is a 25000 loan outstanding. The process is split into three stages as follows. At the end of any accounting period the amount of the insurance premiums that remain prepaid should be reported in the current asset account Prepaid.

Claim receivable was asset but now claim received so credited. This is accomplished with a debit of 1000 to Insurance Expense and a. The initial entry is a debit of 12000 to the prepaid insurance asset account and a credit of 12000 to the cash asset account.

Dr Insurance company debtor 1500 Dr Accumulated depreciation 500 Cr Equipment 2000 Dr Bank 1500 Cr Insurance company 1500 Hope that helps. If full claim is receivable the journal entry is as follows. Company-A paid 10000 as insurance premium in the month of December the insurance premium belongs to the following calendar year hence it doesnt become due until January of the next year.

Explore the latest COVID-19 insights trends and breaking news from propertycasualty insurance industry authority Insurance Journal. Now my GainLoss account shows a debit of 14000 for the fixed asset a credit of 2346517 for the insurance payout and a credit of 1321392 that they paid off the loan with. To insurance claim receivable ac.

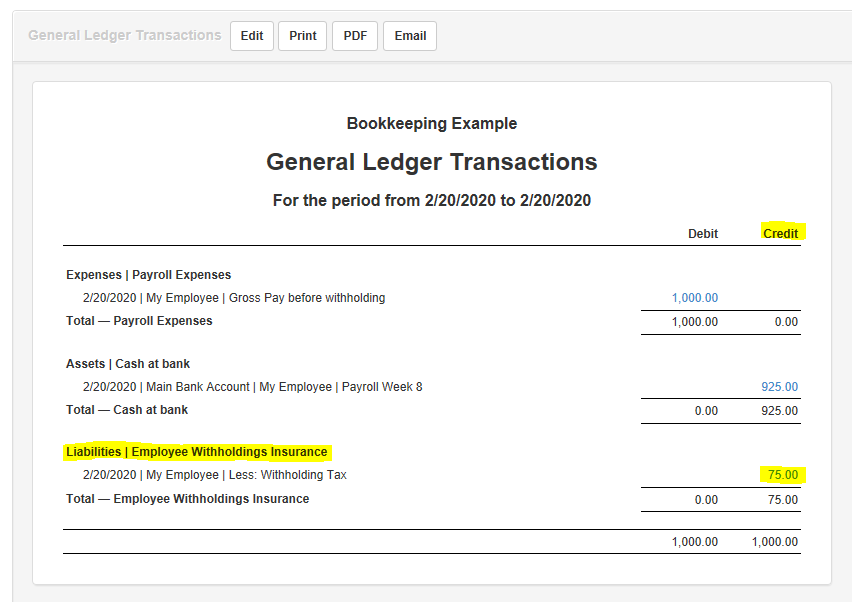

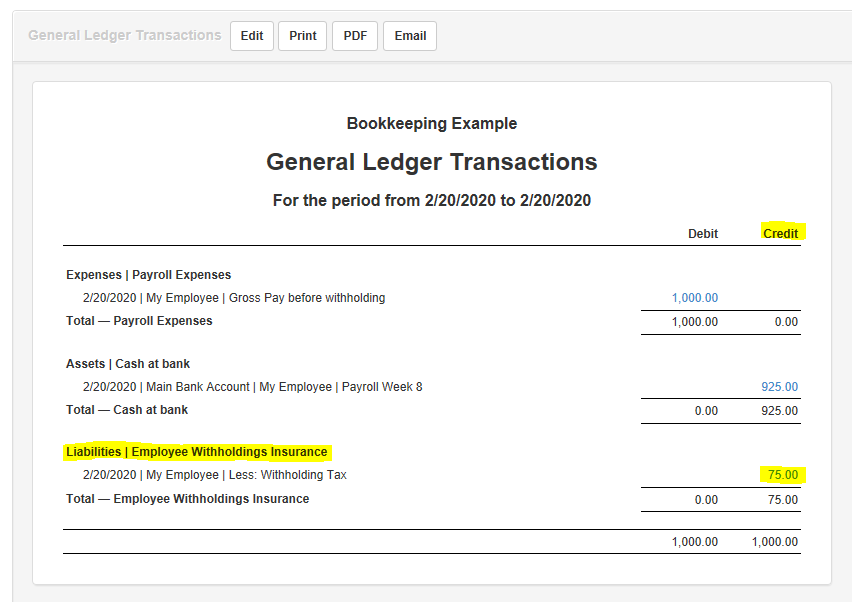

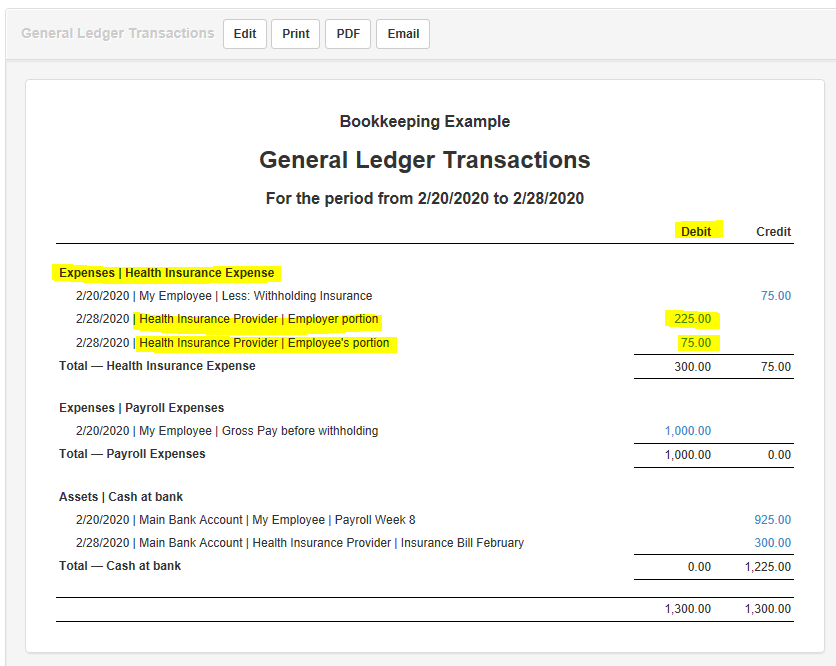

Insurance claim receivable ac dr. The order of the journal entries could be different but they will be similar to this. A journal entry is posted for the amounts received from insurance companies by crediting the actual figures of lost assets against which we claimed insurance.

First you will purchase insurance but since you dont have or want to use your cash you will purchase it on account and agree to pay it within a time period. On December 31 the company writes an adjusting entry to record the insurance expense that was used up expired and to reduce the amount that remains prepaid. Receive the cash from the insurance company.

Their accounts team would prepare the following calculation and journal entry. Loan Account - 25000. The entry here would be an increase in prepaid insurance and an increase in accounts payable.

The debit of 5342 creates the insurance paid in advance or prepaid account a current asset in ABCs balance sheet statement of financial position. The journal entry would be. The initial entry is a debit of 12000 to the prepaid insurance asset account and a credit of 12000 to the cash asset account.

If the insurance company accepts our claims after a thorough investigation of the loss we can record them as debtors.

Insurance Journal Entry For Different Types Of Insurance

Accounting For Insurance Claim Destruction Of Asset Manager Forum

0 Comments